Customers get up to Rs 2 lakh insurance cover on debit card and monthly payout of interest

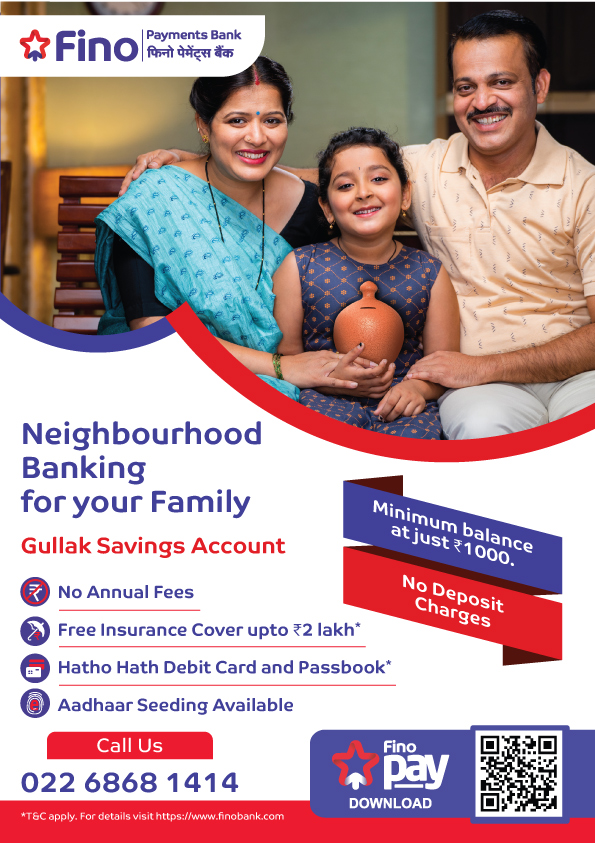

Ahmedabad 11 November 2024: Having made banking easy, simple and convenient, Fino Payments Bank is now focusing on making customers save more. Continuing its efforts towards creating value for customers, Fino Bank has today announced the launch of a new savings account “Gullak” aimed at improving savings by offering a range of benefits designed to meet the unique needs of customers.

One can open Gullak account at any of Fino Bank’s around 27500 merchant points spread across the state of Gujarat and enjoy the benefits. With a minimal account balance of Rs 1000, Gullak account holders need not pay any annual plan fee, get to make cash deposits without any charges, avail 7 free ATM transactions in non-metro locations and enjoy offers on Rupay debit card. An exciting proposition is the waiver of the minimum account balance on meeting certain criteria.

These include, five UPI transactions through FinoPay mobile app in a month valued at Rs 500 or booking a one-year Fixed Deposit of at least Rs 5000 issued by Fino’s partner bank or credit of any government welfare scheme benefit in the account. If customers meet any one of the three criteria, then even if the account balance is less than Rs 1000 there will not be any charges for non-maintenance of minimum balance.

Gullak (Piggy Bank) assumes significance in today’s context where majority of people withdraw all or most of the money from their bank accounts, thereby losing the opportunity to save and invest.

Announcing the launch of Gullak savings account Mr. Umesh Kadam, Zonal Head, Fino Payments Bank said, “Customers need to aim towards higher savings to create a corpus for future expenses as well as any emergency requirements, avoiding the need to take loans. Our endeavor with Gullak is to help account holders develop a savings first mindset, with focus on safety and growth. Higher deposits allow customers to earn attractive interest rates going up to 7.75% annually. With a minimum balance of Rs 1000 in the account customers get an instant, Haatho Haath debit card with up to Rs 2 lakh insurance cover along with access to multiple benefits including monthly payout of interest.”

With Gullak savings account Fino Bank aims to target customers with the ability to keep higher balances and value savings based growth. Primarily they could be young professionals, small entrepreneurs, working women as well as self-employed. Customers with the potential to save more than Rs 2 lakhs can do so with Gullak, wherein the excess of Rs 2 lakh gets deposited in a sweep account of a partner bank offering a higher interest rate. With Gullak, Fino’s neighbourhood banking services aim at increased engagement and financial well-being of customers.

Further, Fino’s neighbourhood points are open for extended hours where any bank’s customer can transact, do deposits, withdrawals, money transfer and access third party products such as life, health, and motor insurance, referral loans, and pay utility bills. #Hamesha!